(London, October 13, 2017) – International policy makers are meeting in Europe and Washington, D.C. this week to consider the deteriorating economic and political situation in the Democratic Republic of Congo. They will need to confront a stark truth: the growing evidence linking President Joseph Kabila, his family and close associates to bribery and corruption.

Ignoring this fact will result in political pressure that is unlikely to have much impact. Tackling it requires diplomats and their law enforcement agencies to act against international mining companies and investors linked to Kabila who operate in their own jurisdictions. It’s a thorny issue that cannot be shied away from.

So far, policy makers have focused on politics. Kabila’s term of office expired in December 2016, when his second term of office ended. He has retained power by delaying elections and overseeing a brutal crackdown against peaceful dissent. An agreement brokered by the Catholic Church for elections to be held in 2017, in which Kabila would not participate, has been largely ignored. The national election commission has declared publicly that it has yet to set a date.

The US and EU have responded by imposing targeted sanctions, including travel bans and assets freezes, against 17 individuals, mainly those in the security forces responsible for the abuses. To date they have not sanctioned Kabila, his family members or financial associates. That should change.

Since coming to power in 2001, Kabila and his family have amassed a fortune through their stakes in more than 80 companies, earning them tens of millions of dollars, according to new research published in July by the Congo Research Group. The president has authority to approve or reject oil permits, has direct control over a $13 billion hydropower project, a $6 billion Chinese minerals contract and exercises considerable authority over other major mining deals.

The concentration of power in the president’s office and the lack of transparency has deprived the state of valuable resources it desperately needs to tackle poverty and a growing humanitarian crisis. Almost 80% of its 69 million people live on less than $1.90 a day. In recent months, the salaries of many government workers have been paid late and, with 50% inflation, they are worth less each month.

Recently released legal documents from the US Department of Justice investigating bribery by a US-based hedge fund, Och-Ziff, show the extent of the corruption related to just one set of mining deals. They illustrate that Congolese officials received over $100 million in bribes via Och-Ziff’s partner in Congo, “an Israeli businessman”, easily identifiable as Dan Gertler, in exchange for lucrative mining assets. Gertler’s Fleuette Group have denied the allegations.

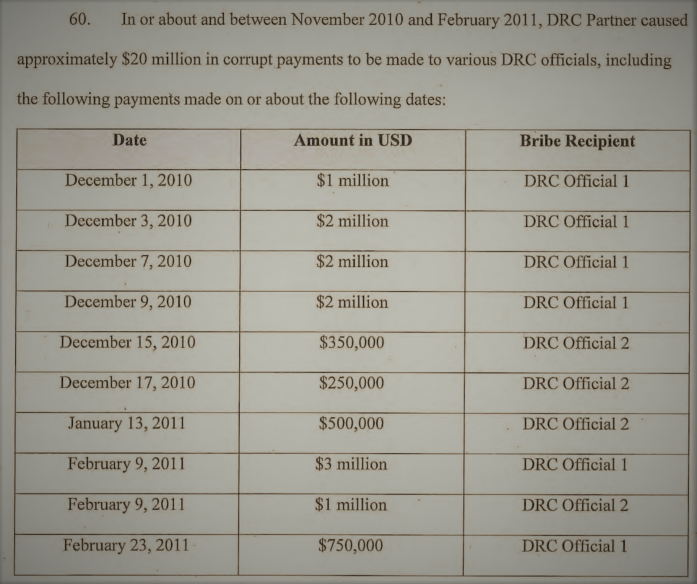

The documents show President Kabila himself received $10.7 million in bribes from Gertler over a short three-month period between December 2010 and February 2011. Although US officials use the pseudonyms “DRC Official 1” and “DRC Partner” in the documents, it is easy to discern, as many journalists have, the identities are Kabila and Gertler. A recent report from UK-based NGO Rights and Accountability in Development (RAID) sets out the corrupt deals in stark detail.

US justice officials provided a detailed table in their legal filing, illustrating the amounts and dates when the funds were transferred to Kabila and to his then senior financial advisor, “DRC Official 2”, identifiable as Katumba Mwanke. This is the clearest evidence to date of corruption directly involving the president. It is likely to be the tip of the iceberg.

Table of bribery payments made by “DRC Partner” [Dan Gertler] to “DRC Official 1” [President Kabila] and his then financial advisor, “DRC Official 2” [Katumba Mwanke], from Statement of Facts US Department of Justice. ©US Department of Justice, Sept 2016.

Some International mining companies have been able to take advantage of the lack of accountability to secure profitable deals, often involving the facilitation of Gertler. Only a few have faced scrutiny, in part because the lack of fiscal transparency in Congo and foreign tax havens makes it hard to fully scrutinize the deals, detect beneficial owners and detect corrupt practices.

The UK’s Serious Fraud Office is investigating Kazakh multinational mining company ENRC, who appear at the heart of several related deals. Gertler is part of the investigation, according to an SFO letter leaked to the press. ENRC was listed on the London Stock Exchange until it delisted in scandal in 2013. Canadian regulatory authorities are investigating Katanga Mining Ltd., a subsidiary of the Swiss based Glencore, for possible irregularities in their listing on the Toronto Stock Exchange. In February 2017, Glencore paid nearly $1 billion to buy Gertler’s remaining shares of two giant Congolese cobalt and copper mines, and severed its ties with him.

These investigations are welcome, but more should be done. Policy makers should expand sanctions to include Kabila, his family and financial associates involved in serious corruption, misuse of government funds, money laundering, or fraud. At the same they should step-up legal action and scrutiny of companies listed or operating in their own jurisdictions who facilitate such unlawful activity.

Action on both fronts is needed to tackle the thorny issue of corruption and graft at the heart of Congo’s crisis.

—

Anneke Van Woudenberg is the Executive Director of Rights and Accountability in Development (RAID).

http://www.raid-uk.org/documents/blog-greedandcorruptionblockcongosdemoc…